Total Of All Indirect Costs Is Known As . — the key difference underpinning these two terms—direct and indirect costs—is their traceability. Indirect costs are costs used by multiple activities, and which cannot therefore be. Indirect costs may be fixed or variable. — the formula for allocating indirect costs is: — indirect costs, or overheads, are. Total indirect costs / total direct costs = indirect cost rate. — what are indirect costs? indirect costs are costs that are not directly related to a specific cost object. indirect costs are those expenses that are incurred in common for different projects, products, or business activities and. the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. Having a firm understanding of the. For example, if a company had $100,000 in.

from www.patriotsoftware.com

indirect costs are those expenses that are incurred in common for different projects, products, or business activities and. Total indirect costs / total direct costs = indirect cost rate. For example, if a company had $100,000 in. Having a firm understanding of the. — the key difference underpinning these two terms—direct and indirect costs—is their traceability. — what are indirect costs? — the formula for allocating indirect costs is: Indirect costs are costs used by multiple activities, and which cannot therefore be. — indirect costs, or overheads, are. Indirect costs may be fixed or variable.

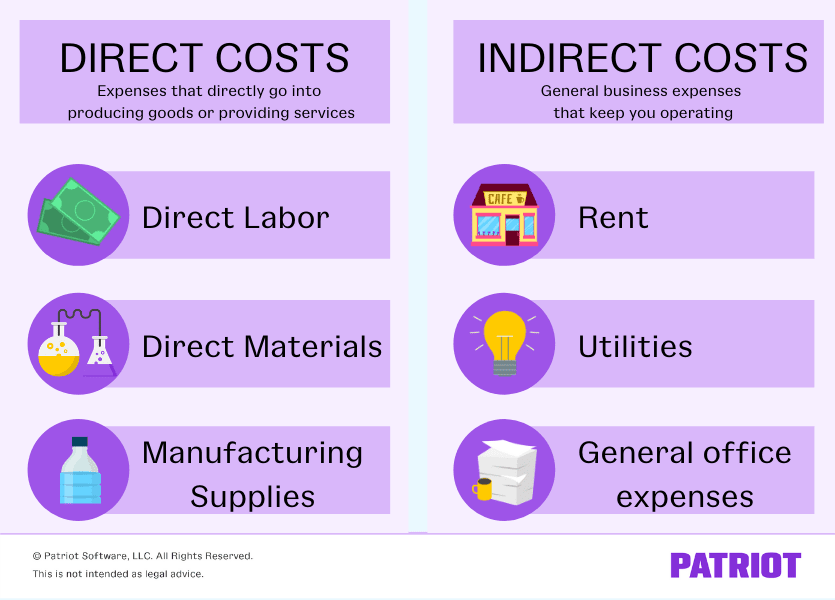

Direct vs. Indirect Costs What's the Difference?

Total Of All Indirect Costs Is Known As the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. indirect costs are those expenses that are incurred in common for different projects, products, or business activities and. Indirect costs are costs used by multiple activities, and which cannot therefore be. — the formula for allocating indirect costs is: — indirect costs, or overheads, are. Indirect costs may be fixed or variable. Total indirect costs / total direct costs = indirect cost rate. For example, if a company had $100,000 in. the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. — what are indirect costs? — the key difference underpinning these two terms—direct and indirect costs—is their traceability. indirect costs are costs that are not directly related to a specific cost object. Having a firm understanding of the.

From planergy.com

How To Calculate Your Company's Indirect Costs Planergy Software Total Of All Indirect Costs Is Known As Having a firm understanding of the. Indirect costs are costs used by multiple activities, and which cannot therefore be. indirect costs are those expenses that are incurred in common for different projects, products, or business activities and. — indirect costs, or overheads, are. — the formula for allocating indirect costs is: Indirect costs may be fixed or. Total Of All Indirect Costs Is Known As.

From learningschoolgraciauwb.z4.web.core.windows.net

Formula For Calculating Indirect Cost Rates Total Of All Indirect Costs Is Known As Indirect costs are costs used by multiple activities, and which cannot therefore be. Indirect costs may be fixed or variable. Total indirect costs / total direct costs = indirect cost rate. indirect costs are those expenses that are incurred in common for different projects, products, or business activities and. — the formula for allocating indirect costs is: . Total Of All Indirect Costs Is Known As.

From www.slideserve.com

PPT INDIRECT COSTS / ADMINISTRATIVE COSTS PowerPoint Presentation Total Of All Indirect Costs Is Known As the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. Indirect costs are costs used by multiple activities, and which cannot therefore be. Total indirect costs / total direct costs = indirect cost rate. — the key difference underpinning these two terms—direct and indirect costs—is their traceability. Having a. Total Of All Indirect Costs Is Known As.

From www.slideshare.net

Activity based costing Total Of All Indirect Costs Is Known As For example, if a company had $100,000 in. the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. Having a firm understanding of the. — indirect costs, or overheads, are. — the formula for allocating indirect costs is: indirect costs are costs that are not directly related. Total Of All Indirect Costs Is Known As.

From www.facebook.com

Divine Service September 29, 2024 Divine Service September 29 Total Of All Indirect Costs Is Known As indirect costs are costs that are not directly related to a specific cost object. — the formula for allocating indirect costs is: Indirect costs are costs used by multiple activities, and which cannot therefore be. the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. indirect costs. Total Of All Indirect Costs Is Known As.

From pakmcqs.com

The budgeted total cost in indirect cost pool, is divided by budgeted Total Of All Indirect Costs Is Known As indirect costs are costs that are not directly related to a specific cost object. Total indirect costs / total direct costs = indirect cost rate. Having a firm understanding of the. Indirect costs are costs used by multiple activities, and which cannot therefore be. — the formula for allocating indirect costs is: Indirect costs may be fixed or. Total Of All Indirect Costs Is Known As.

From www.wallstreetmojo.com

Direct Cost vs Indirect Cost Top 7 Differences (Infographics) Total Of All Indirect Costs Is Known As Indirect costs are costs used by multiple activities, and which cannot therefore be. Total indirect costs / total direct costs = indirect cost rate. the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. indirect costs are those expenses that are incurred in common for different projects, products, or. Total Of All Indirect Costs Is Known As.

From www.patriotsoftware.com

What's the Difference Between Direct vs. Indirect Costs? Total Of All Indirect Costs Is Known As — the formula for allocating indirect costs is: the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. — the key difference underpinning these two terms—direct and indirect costs—is their traceability. indirect costs are costs that are not directly related to a specific cost object. —. Total Of All Indirect Costs Is Known As.

From www.slideserve.com

PPT INDIRECT COST RATES PowerPoint Presentation, free download ID Total Of All Indirect Costs Is Known As Total indirect costs / total direct costs = indirect cost rate. — the key difference underpinning these two terms—direct and indirect costs—is their traceability. Indirect costs are costs used by multiple activities, and which cannot therefore be. — indirect costs, or overheads, are. — the formula for allocating indirect costs is: Having a firm understanding of the.. Total Of All Indirect Costs Is Known As.

From www.facebook.com

Divine Service September 29, 2024 Divine Service September 29 Total Of All Indirect Costs Is Known As — the key difference underpinning these two terms—direct and indirect costs—is their traceability. Having a firm understanding of the. the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. — the formula for allocating indirect costs is: Total indirect costs / total direct costs = indirect cost rate.. Total Of All Indirect Costs Is Known As.

From planergy.com

How To Calculate Your Company's Indirect Costs Planergy Software Total Of All Indirect Costs Is Known As — indirect costs, or overheads, are. indirect costs are those expenses that are incurred in common for different projects, products, or business activities and. Indirect costs may be fixed or variable. indirect costs are costs that are not directly related to a specific cost object. the indirect cost definition aids in the development of the following. Total Of All Indirect Costs Is Known As.

From www.bookstime.com

What is Indirect Cost? BooksTime Total Of All Indirect Costs Is Known As Indirect costs are costs used by multiple activities, and which cannot therefore be. indirect costs are those expenses that are incurred in common for different projects, products, or business activities and. — the key difference underpinning these two terms—direct and indirect costs—is their traceability. For example, if a company had $100,000 in. — indirect costs, or overheads,. Total Of All Indirect Costs Is Known As.

From www.slideserve.com

PPT Cost classification PowerPoint Presentation, free download ID Total Of All Indirect Costs Is Known As Indirect costs may be fixed or variable. For example, if a company had $100,000 in. Having a firm understanding of the. — indirect costs, or overheads, are. indirect costs are costs that are not directly related to a specific cost object. Total indirect costs / total direct costs = indirect cost rate. — the formula for allocating. Total Of All Indirect Costs Is Known As.

From www.wikihow.com

How to Calculate Total Cost 13 Steps (with Pictures) wikiHow Total Of All Indirect Costs Is Known As Indirect costs may be fixed or variable. Indirect costs are costs used by multiple activities, and which cannot therefore be. — indirect costs, or overheads, are. — the formula for allocating indirect costs is: indirect costs are those expenses that are incurred in common for different projects, products, or business activities and. — what are indirect. Total Of All Indirect Costs Is Known As.

From www.jamesoncpa.com

FAR Part 31 Indirect Cost Rates Jameson & Company Total Of All Indirect Costs Is Known As — the key difference underpinning these two terms—direct and indirect costs—is their traceability. Indirect costs may be fixed or variable. Indirect costs are costs used by multiple activities, and which cannot therefore be. — the formula for allocating indirect costs is: Total indirect costs / total direct costs = indirect cost rate. — indirect costs, or overheads,. Total Of All Indirect Costs Is Known As.

From www.facebook.com

Sept. 24 Private equity and forprofit healthcare Private equity's Total Of All Indirect Costs Is Known As Having a firm understanding of the. Total indirect costs / total direct costs = indirect cost rate. — the formula for allocating indirect costs is: the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. Indirect costs are costs used by multiple activities, and which cannot therefore be. . Total Of All Indirect Costs Is Known As.

From www.slideserve.com

PPT INDIRECT COSTS PowerPoint Presentation, free download ID758427 Total Of All Indirect Costs Is Known As — the key difference underpinning these two terms—direct and indirect costs—is their traceability. — indirect costs, or overheads, are. — what are indirect costs? — the formula for allocating indirect costs is: indirect costs are costs that are not directly related to a specific cost object. Having a firm understanding of the. Indirect costs are. Total Of All Indirect Costs Is Known As.

From blog.constellation.com

Understanding Direct vs. Indirect Costs Constellation Total Of All Indirect Costs Is Known As Having a firm understanding of the. Total indirect costs / total direct costs = indirect cost rate. the indirect cost definition aids in the development of the following equation or formula to determine the proportion of. indirect costs are those expenses that are incurred in common for different projects, products, or business activities and. For example, if a. Total Of All Indirect Costs Is Known As.